Contributors in the Federal Workers Wellness Rewards (FEHB) Application have new factors to contemplate creating alterations to their wellness treatment enrollments.

The Inflation Reduction Act (IRA), enacted last August, incorporated substantial alterations to Medicare Component D, the segment of Medicare that requires prescription drug coverages.

For FEHB participants, the changes from the IRA strengthen the worth of enrolling in Portion D, according to Kevin Moss, editor of Consumers’ Checkbook Guideline to Wellness Designs for Federal…

Examine Additional

Participants in the Federal Workers Wellness Rewards (FEHB) Method have new reasons to contemplate creating adjustments to their health treatment enrollments.

The Inflation Reduction Act (IRA), enacted very last August, included significant alterations to Medicare Section D, the segment of Medicare that involves prescription drug coverages.

For FEHB individuals, the modifications from the IRA make improvements to the value of enrolling in Part D, according to Kevin Moss, editor of Consumers’ Checkbook Information to Wellness Ideas for Federal Workers.

Some of the IRA’s adjustments to Medicare Portion D have already taken effect, though some others will roll in more than the subsequent several many years.

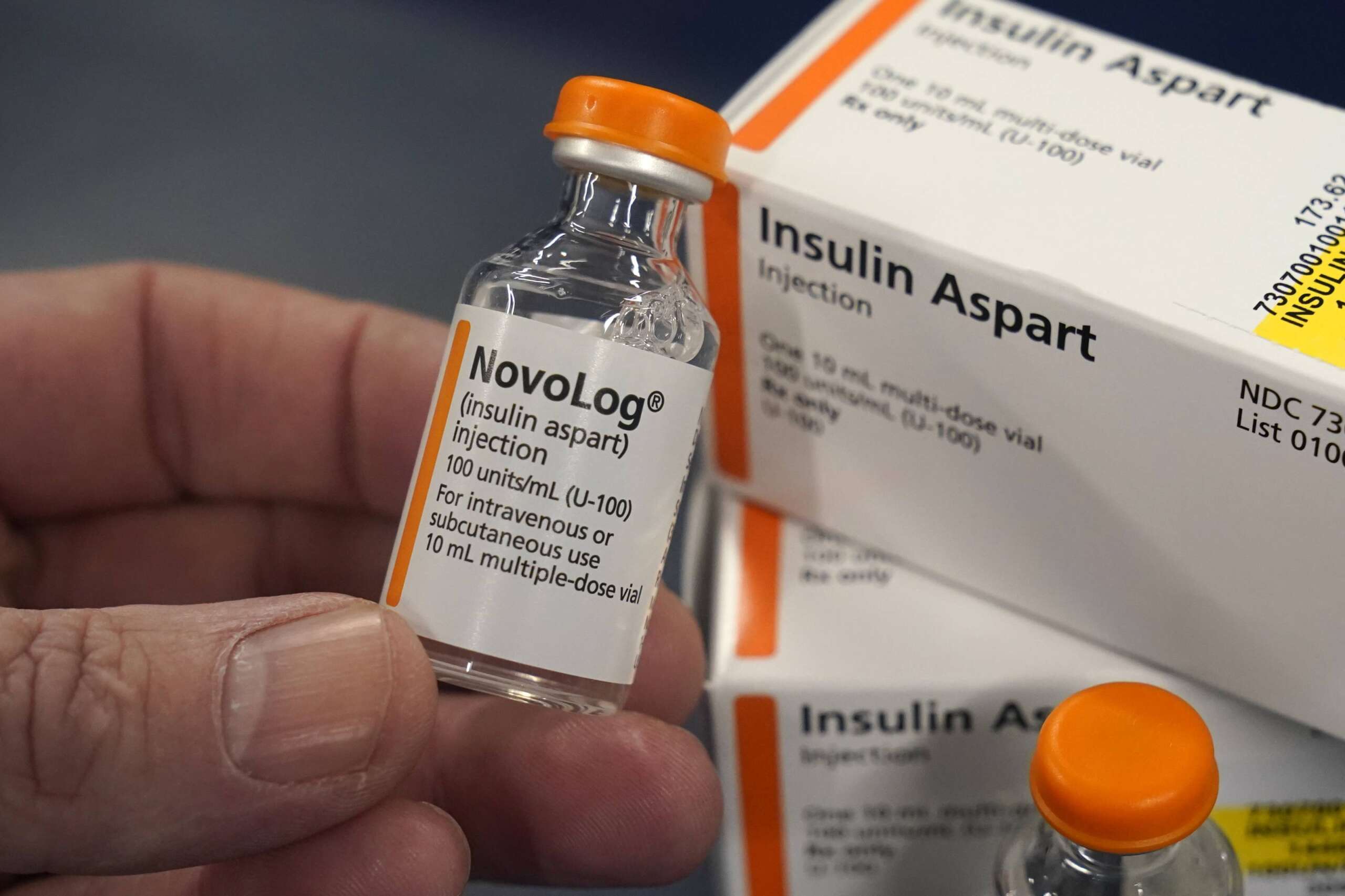

The regulation has now positioned a $35-for each-month cap on the value of insulin, which begun in January this calendar year. But in advance of participants make the change into a program that has Medicare Portion D, they must very first look at their present-day FEHB strategy, to see if it already gives insulin for fewer than $35 per thirty day period.

“For individuals who choose insulin, this is welcome news,” Moss reported in a Fed Life interview. “This specific provision may possibly assistance you, or it could not. Our tips is constantly make positive you’re comparing your current FEHB prepare with what’s out there in a Aspect D strategy.”

In one more provision of the IRA, the legislation dropped costs to FEHB enrollees just after they strike what’s called “catastrophic coverage” beneath Medicare Aspect D. Annuitants strike this section of coverage the moment their total expending has achieved $7,400 in a year. At present, through catastrophic protection, enrollees continue to have to pay out a 5% share.

But starting up in 2024, that 5% charge to enrollees will be removed underneath Medicare Component D plans.

The legislation will also avoid Section D premiums from increasing by far more than 6% in a 12 months. The quality cap will start out in 2024 and last through 2030.

Moss mentioned the cap is a significant safeguard for FEHB enrollees, due to the fact rates for Component D improved by 10% final calendar year.

“If you’re thinking with these increased positive aspects that the Portion D ideas might be jacking premiums, no – there are protections that will guard people in those people options,” he claimed.

But the actual “game-changer” from the IRA, Moss explained, is a $2,000 cap on out-of-pocket shelling out for enrollees in Medicare Aspect D — that spending can also be spread all through a comprehensive 12 months.

“[That] fundamentally means no 1 will ever be having to pay more than $170 in a month on out-of-pocket prescription prescription drugs,” Moss stated. “For any annuitants that have average-to-high prescription drug charges … this will be a actually massive offer.”

The out-of-pocket paying cap will consider effect in 2025.

How to indicator up for Medicare Component D

There are two techniques FEHB participants ages 65 and older can enroll in Medicare Portion D – possibly by enrolling in a Medicare Edge program, or signing up for a supplemental prescription drug plan.

The choice that individuals choose, or whether or not they enroll in the very first area, mainly relies upon on their recent use of prescription drugs, Moss explained.

Annuitants who have increased prescription drug use should think about which of the two Part D enrollment choices operate most effective for them for 2024. But annuitants with lessen prescription drug utilization can wait to sign up for Aspect D — there will not be a late enrollment penalty if they change their mind and enroll in the foreseeable future.

For the to start with enrollment possibility, FEHB participants can get Aspect D by picking a system that has Medicare Edge, also acknowledged as Medicare Part C. Annuitants should be enrolled in Medicare Components A and B to qualify for this type of program.

Medicare Gain programs in just FEHB can outcome in significant price tag savings for enrollees, because these varieties of options lower or from time to time solely eradicate the high quality for Medicare Component B.

“For nearly just about every federal annuitant, an FEHB Medicare Advantage system will be the lowest value option for you,” Moss claimed.

In the earlier, federal annuitants were ordinarily far better off not getting Medicare Part D, considering the fact that previous FEHB prescription drug coverage was just as excellent, or far better, than what Element D features, and with no further quality.

But that has altered in just the earlier numerous many years, and the craze will probably go on in the foreseeable future.

Stepping away from its regular recommendations, the Office of Staff Administration is now encouraging FEHB carriers to supply extra Medicare Gain programs for federal annuitants ages 65 and more mature.

“Recent variations to rules regarding Medicare drug benefits have designed the setting more favorable for FEHB enrollees who are Medicare suitable to reward from their Portion D eligibility,” OPM Associate Director of Healthcare and Insurance Laurie Bodenheimer reported in a Jan. 25 letter to FEHB carriers.

Some FEHB programs presently supply Medicare Edge, and annuitants can expect to see additional carriers offer you Element D bundle possibilities in the future.

The IRA provisions make Medicare Edge options in particular appealing, Moss mentioned, for the reason that of the forthcoming limit on out-of-pocket expenditures for prescription medication this region of clinical expending can be really costly to enrollees.

The personal savings, while, can be considerable. In some occasions, annuitants can help save near to $8,000 by switching into a Medicare Advantage system, in accordance to Moss.

The second alternative for FEHB members to get Medicare Portion D is by signing up for a supplemental prescription drug prepare.

OPM, in a further modern modify for FEHB, is now letting carriers offer these supplemental prescription drug strategies for Portion D, alongside with their other program choices. These prescription drug options will have to be as superior as, or superior than, present prescription drug coverage, OPM mentioned.

“That language is really critical,” Moss mentioned. “In get for that language to be true, it means that there will be no more quality for you to get that supplemental Aspect D coverage, because it would not be as superior or improved if you had to pay back an added top quality for it.”

OPM said it’s also taking into consideration vehicle-enrollment for these plans, for FEHB members who have Medicare. Members would even now be ready to choose out of the designs, but Moss stated it’s even now significant for contributors to seem thoroughly at that.

“I believe a tiny little bit of research right now that may well be practical is to just take a glimpse at some of the FEHB Medicare Advantage options that are out there presently,” Moss stated. “Take a look at how they work, acquire a glance at their company networks to make absolutely sure the companies that you would use are provided by these options. And genuinely consider whether or not one of these options could preserve you pretty a little bit of income. The FEHB Medicare Edge plans aren’t heading to be right for every person.”

More Stories

Konjac Flour: Fad or Friend on Your Weight Loss Journey?

A In depth Image of Well being Gains of Eggs

Eco-friendly areas endorse well being but really do not terminate discrimination’s results